Hello friends welcome to Sonu live ,in this article I’m going to tell you about Important Functions of India’s Central Bank which is RBI

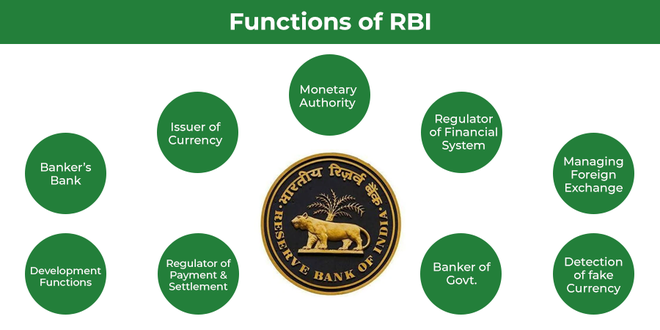

The Reserve Bank of India (RBI) is the central bank of India, established in 1935. It plays a vital role in the country’s economy, performing several crucial functions:

1. Issuing and Managing Currency:

- The RBI has the sole authority to issue banknotes and coins in India.Opens in a new windowen.wikipedia.orgReserve Bank of India logo

- It ensures the smooth circulation of adequate legal tender money to meet the economy’s needs.

- The bank also manages foreign exchange reserves to maintain external stability.

2. Monetary Policy Formulation and Implementation:

- The RBI is responsible for formulating and implementing monetary policy to achieve price stability and economic growth.

- It uses various tools like interest rate adjustments, open market operations, and bank reserve requirements to control the money supply and credit flow in the economy.

3. Regulation and Supervision of Banks and Financial Institutions:

- The RBI acts as the regulator and supervisor of the Indian banking system and other financial institutions.

- It sets prudential norms for banks, issues licenses, and conducts inspections to ensure financial stability and consumer protection.

4. Banker to the Government:

- The RBI acts as the banker to the central and state governments of India.

- It manages the government’s accounts, provides overdraft facilities, and assists in public debt management.

5. Development Banker:

- The RBI plays a crucial role in promoting financial inclusion and development in India.

- It implements various schemes and initiatives to provide financial access to unbanked and underserved sections of the population.

6. Maintaining Payment Systems:

- The RBI oversees and regulates the payment systems in India, including the Real-Time Gross Settlement (RTGS) system and the National Electronic Funds Transfer (NEFT) system.

- It promotes the adoption of digital payments and financial technologies to improve financial inclusion and efficiency.

These are just some of the essential functions of the Reserve Bank of India. The RBI plays a critical role in maintaining macroeconomic stability, promoting financial sector development, and fostering economic growth in India.

I hope this information is helpful! Let me know if you have any other questions.

READ MORE-https://sonulive.in/neet-resut-2023/